Automated Invoice Processing: How to Streamline Your Invoice Process

Maxime Vermeir

September 25, 2023

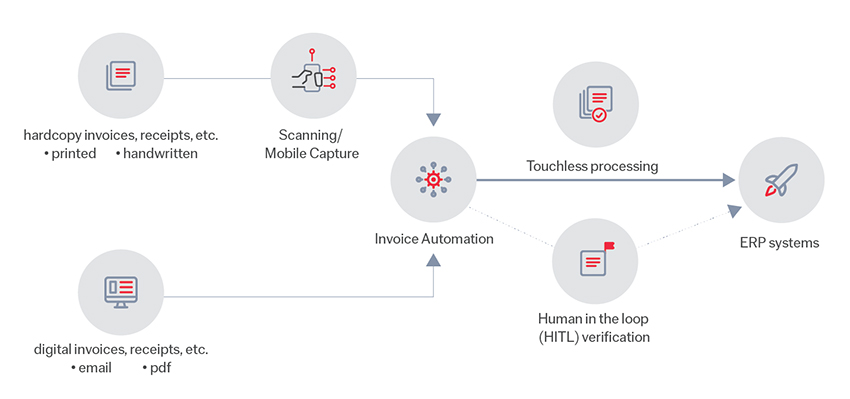

Invoice automation captures, extracts, and validates key data from invoices (both paper and digital) according to business rules. It then delivers the data to information systems such as RPA, BPM, and ERP to facilitate straight-through processing of invoices. No matter the channel that invoices arrive—paper, email, API, MFP/local scanning, mobile device, web-based scanning—all invoices are processed centrally.

Jump to:

What is automated invoice processing?

How invoice automation works

Benefits of automated invoice processing

How to automate invoice processing

What to look for in an invoice automation software

What is automated invoice processing?

Automated invoice processing uses OCR, AI, and ML to extract and process invoice data, streamlining and accelerating the invoice processing workflow.

Companies without automated systems will have to do the process manually, which means a member of staff physically typing data onto a computer, checking the details are correct, verifying the sums against an order, routing it for approval then payment, and keeping it stored and filed for future reference. All this can be extremely time-consuming and error prone.

Automated invoice processing aims to eliminate or minimize these manual processes by leveraging various technologies, such as optical character recognition (OCR), and intelligent document processing (IDP) for:

- Data analysis and extraction

- Data validation and verification

- Exceptions handling

- Workflow management

- Approval and payment

How invoice automation works

Invoice automation captures, extracts, and validates key data from invoices (both paper and digital) in accordance with a company’s rules. It then delivers the data to the company’s information systems such as RPA, BPM, and ERP to facilitate straight-through processing of invoices. No matter the channel that invoices arrive—paper, email, API, MFP/local scanning, mobile device, web-based scanning—all invoices are processed centrally. This is how it works:

1. Scanning and Data Extraction: Invoices received in physical or digital format are scanned or uploaded into the automated system. OCR technology is used to recognize and extract relevant information from the invoices, such as vendor details, invoice number, date, line items, and amounts. In a manual process this would mean an employee reading the paper and transferring the data by typing it onto the computer.

2. Data Validation: The extracted data is then validated against predefined rules and criteria. This helps to identify any discrepancies, errors, or inconsistencies in the invoice data.

3. Matching and Verification: The system can automatically match the invoice data with purchase orders to ensure that the goods or services have been received as expected. This means employees will no longer need to spend time cross-referencing documents to check details are correct.

4. Exception Handling: If any discrepancies or exceptions are detected during the validation and matching process, the system can flag these issues for further investigation and resolution. In the case of a manual process, the employee would need to have an eagle eye and concentrate hard to check for any nuances.

5. Workflow management: Automated workflows are designed to route the invoice through the appropriate approval process based on predefined rules and hierarchies. This can involve sending invoices to various departments or individuals for review and approval. Without automation, an employee may find themselves having to walk down the corridor to another department to find the person responsible for signing off the invoice.

6. Payment: Once the invoice has passed through the necessary validation steps and approvals, the system can trigger the payment process. This might involve generating payment instructions, updating accounting records, and initiating the actual payment to the vendor. Manually doing this process would take a lot of time, with an employee either writing a check, going to the bank, or making a digital payment by inputting the figures and details of the recipient online.

Benefits of automated invoice processing

There are many ways that automation improves invoice processing. These include:

1. Efficiency

Automating invoice processing allows for a more streamlined workflow which eliminates unnecessary steps, reduces bottlenecks, increases performance, and minimizes wasted time. It also enables records to be centralized, which is important for accounts in terms of security, access, and efficiency.

Streamlining accounts also involves identifying and eliminating potential sources of errors, while standardizing processes ensures that tasks are carried out in a consistent manner. When workflows are optimized, decision-making becomes more straightforward and tasks completed faster, ultimately boosting productivity.

2. Accuracy

Humans can get tired and distracted when reading, inputting, or comparing data, which can lead to errors. Automating invoice processing takes away that problem as three-way matching brings accuracy, validation, improved performance, and consistency.

In three-way matching, the purchase order will be matched against goods received, then the purchase order will also be matched to the invoice for quantity and pricing. The automated system will also ensure further accuracy by matching the invoice against the goods received report. This three-way check helps organizations avoid overpayment, underpayment or incorrect payments while enhancing overall efficiency.

3. Compliance

Invoice automation can save employees from having to perform manual data entry, freeing them to focus on higher value tasks. It also helps AP departments to avoid making late or duplicate payments.

Most companies see a 90% improvement in invoice processing times. Employee productivity increases by 400% and accounts staff spend 30% less time responding to queries. With straight through processing, invoices that used to take 1-2 days to process for payment, can now be completed in less than an hour.

4. Cost Savings

Cost savings are always a major factor for switching to automated invoice processing. A good AP automation system will allow companies to benefit from 91% lower processing costs.

Recent surveys suggest that cross-industry, median AP cost/invoice is $11 while the best-in-class companies only spend $3 or less per invoice. With invoice automation, organizations also save money by being able to take advantage of early payment discounts.

Construction and engineering company Costain receives 400,000 invoices and was able to save nine minutes per invoice through undergoing digital transformation with ABBYY, bringing a significant amount of savings for the company.

5. Visibility

Automation provides real-time tracking and reporting on the status of invoices. This visibility into the invoice lifecycle helps businesses keep track of outstanding payments, forecast expenses, and make more informed financial decisions.

ABBYY FlexiCapture for Invoices

Intelligent, scalable and flexible solution for invoice automation.

How to automate invoice processing

1. Choose an Invoice Processing Solution

Chose a turnkey automated invoice processing solution that automates the capture, recognition, field extraction, and validation of data, making straight-through processing of PO-based invoices easy and accurate.

2. Customize the workflow

Be strategic about the arrangement of different steps, actions, and decisions that individuals follow to efficiently and effectively complete invoice processing in your organization. Customizing a workflow involves adapting and configuring the workflow to match the unique requirements, preferences, and constraints of your situation.

3. Integrating with other accounting systems

Invoice automation can be used with the ERP infrastructure that’s already in place within an organization. Leading providers of invoice processing software offer free connectors with market-leading solution providers of information systems and accounting systems. This can provide a positive return on investment with low costs and a short time for integration. Extracted and verified invoice data (and images) are delivered to the systems that need it—RPA, CRM, ERP, BPM, ECM, and accounting systems—providing an end-to-end, smarter, faster accounts payable automated workflow.

4. Testing and reviewing

Customized workflows need to be tested in a controlled environment to gather feedback. You can make necessary adjustments based on the feedback received. It is also important to continuously monitor the workflow's performance, gather data, and analyze its effectiveness. You can identify areas that require further optimization and make necessary changes. As the context changes or new requirements arise, be prepared to adapt, and modify the customized workflow to remain relevant and effective.

What to look for in an invoice automation software

Selecting the right invoice automation software for your business is a crucial decision that can greatly impact your efficiency and accuracy in managing invoices and financial processes. Here are some key factors to consider when evaluating different options:

- Integration Capabilities: The software should be able to integrate seamlessly with your existing accounting, ERP, and other relevant systems. This integration streamlines data flow and reduces manual data entry.

- Ease of Use and User Interface: Ensure the software has an intuitive and user-friendly interface. It should be easy for your team to learn and use without requiring extensive training.

- Automation Features: Look for features like automatic data capture, invoice matching, and approval workflows. These features can help reduce manual tasks and speed up the invoice processing cycle.

- Data Extraction and OCR: Optical Character Recognition (OCR) technology allows the software to extract key data from scanned or photographed invoices. Accurate OCR with pre-trained extraction models is essential for automating data entry.

- Three-way matching: The software should accurately match invoices with purchase orders and receipts, minimizing errors and discrepancies.

- Approval Workflows: A flexible approval workflow is essential for managing invoices. It should allow for multi-level approvals and notifications to ensure timely processing.

- Data Security and Compliance: Ensure the software meets industry standards for data security and compliance, especially if it handles sensitive financial information.

- Scalability: Choose software that can grow with your business. It should be able to handle an increasing volume of invoices and adapt to your changing needs.

- Customization and Configuration: The software should allow you to customize fields, workflows, and processes to align with your business's unique requirements.

- Reporting and Analytics: Choose software that provides insights into invoice processing times, approval bottlenecks, and other key performance metrics. This can help you identify areas for improvement.

- Mobile Access: Having mobile access to the software can be valuable for approving invoices on the go and staying informed about the invoice processing status.

- Vendor Support: Consider the level of customer support offered by the software vendor. Timely assistance is important if you encounter issues or need help with customization.

- Cost and ROI: Evaluate the software's cost against the potential time and cost savings it offers. Calculate the return on investment (ROI) based on efficiency gains and reduced errors.

Make the switch to invoice automation

Now you’ve heard about the benefits of automating invoice processing, it’s time to take action and reap the rewards of lower costs, increased productivity and more accuracy. ABBYY has helped many global organizations lower invoice processing costs, and drastically expedite invoice processing time with our invoice processing software. Take a look at how it can help your company or request a no obligation demo:

Frequently asked questions

Why ABBYY?

ABBYY has been named a leader in IDP by 10 analyst firms. We process 1.5 billion invoices every year, using machine learning, natural language processing and AI to provide customers with up to 91% reduction in invoice processing costs.

What are the major differences between manual and automated invoice processing?

There a several major differences between manual and automated invoice processing which involves things like:

Human Involvement: In manual invoice processing, human employees are responsible for tasks such as receiving, sorting, data entry, verification, and approval of invoices. This can be time-consuming and prone to errors. Automated invoice processing relies on software and technology to handle this work, reducing the need for manual data entry and verification.

Efficiency: Manual processing is slower and more labor-intensive. It involves physical handling of paper documents, which can lead to delays in approvals and payments. Automated processing is much faster, as it can extract and process data from invoices electronically. This leads to quicker approvals, payment processing, and overall streamlined workflows.

Accuracy: Manual data entry can introduce errors, such as typos, transcription mistakes, and calculation errors. Automated processing minimizes human errors by using OCR (Optical Character Recognition) technology to accurately extract data from invoices. Validation checks can further enhance accuracy.

Cost-Effectiveness: Manual processing can be costly due to the need for a larger workforce and potential errors that require correction. While there is an upfront cost associated with implementing automated systems, they can result in long-term cost savings by reducing the need for manual labor and decreasing error-related expenses.

Scalability: Scaling up manual invoice processing requires hiring more employees, which can lead to increased administrative overhead and training needs. Automated systems can handle higher invoice volumes without significant increases in human resources, making them more scalable.

Compliance and Audit Trail: Manual processing might lack a robust audit trail, which can be problematic for compliance and tracking purposes, while automated systems can maintain detailed records of every step in the invoice processing cycle, aiding compliance efforts and audits.

Data Accessibility and Analysis: Extracting meaningful insights from manual processes can be challenging due to the dispersed nature of data. Automated systems store data in a centralized manner, making it easier to analyze trends, identify bottlenecks, and make informed decisions.

Integration: Integrating manual processes with other systems (e.g., accounting software, ERP systems) can be complex and error-prone. Automated systems can seamlessly integrate with other software systems, improving data flow and reducing the risk of errors during data transfer.

How much time does automated invoice processing save?

Invoice automation can save employees from having to perform manual data entry, freeing them to focus on higher value tasks.

Most companies see a 90% improvement in invoice processing times. Employee productivity increases by 400% and employees spend 30% less time responding to queries. Invoices that used to take 1-2 days to process payment can now be completed in less than an hour.

Can automated invoice processing do more than automate invoices?

Yes, not only does it save time and money for the company through improved productivity and efficiency, but automating invoice processing can bring other benefits such as helping enforce compliance with company policies, vendor agreements, and regulatory requirements.

Automated systems are also better for extracting meaningful insights about the company as data is stored in a centralized manner, making it easier to analyze trends, identify bottlenecks, and make informed decisions.

In addition, automation can bring happier employees as they are relieved of repetitive and mundane tasks like data entry. It can also lead to better customer service as faster processing times can mean faster response times, quicker decisions, and earlier payments.