Digital Strategies in Financial Services: Read Our Latest Survey Results

Cheryl Chiodi

November 22, 2021

Financial Services institutions have long pursued automation opportunities to accelerate lending processing, expedite regulatory reporting, monitor and detect fraud, and a whole host of processes that can be fraught with fractured, content-intensive processes. This quest has only accelerated during the COVID-19 pandemic, and that haste has sometimes created costly blind spots, risks, and inefficiencies.

ABBYY commissioned Gatepoint Research to conduct a survey to senior decision makers from financial institutions located in North America. The findings show that Financial Services leaders continue to be committed to creating exceptional customer experiences while lowering risk of compliance violations, and another top-of-mind priority is empowering employees with smarter tools.

Access the full findings of the Digital Strategies in Financial Services Survey here.

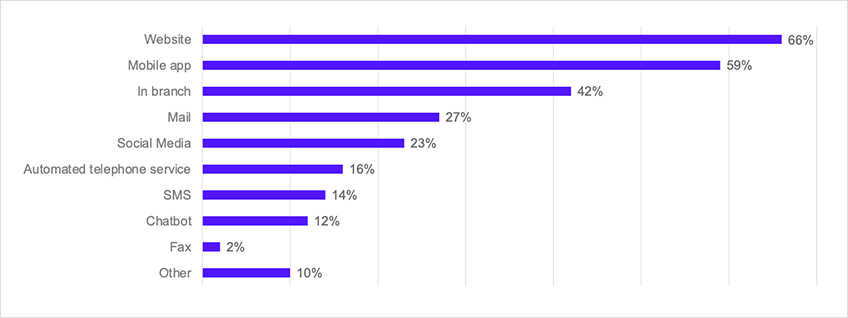

Channels of engagement

Financial Services customers expect a consistent experience across channels and are demanding personalized, real-time engagement. They are also growing more sensitive regarding the time spent interacting with financial institutions and the ease to solve issues through different channels.

Financial Services providers must focus on improving integration across channels, and if they are to sharpen their competitive edge, they must focus on serving their customers on the channel of their choosing. According to S&P Global Market Intelligence, U.S. banks closed a record 3,324 branches nationwide in 2020, and opened 1,040, for a net loss of 2,284 branches.

ABBYY research showed that in-branch banking is still a highly sought-after channel (42 percent and the third most popular channel); this may be due to the fact that, for many banks, the shift from in-person to online exposed gaps in their online and mobile banking options, which raised a number of pressing questions regarding functionality. Or, perhaps, it has more to do with the nature of the branch visit—if it’s for complex transactions, or guiding a borrower through confusing disclosures and qualification paperwork, or a consultation regarding developing investment strategies.

Whatever the usage is, one thing is clear: in order for financial institutions to combat the growing challenges around loyalty, persistent churn, and fragmented attention, they must restore trust and build long-term customer advocacy through a dedication to consistent, personalized experiences—on the device and channel of the customer’s choosing.

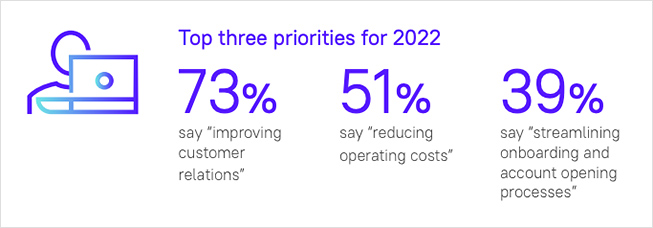

Near-term investment

In the coming year, financial institutions surveyed say they will focus most often on three priorities: improving customer relations (say 73 percent of respondents), reducing operating costs (51 percent), and streamlining onboarding and account opening processes (39 percent).

Visibility into automation success

We are seeing a dramatic increase in automation advancement in Financial Services. While the trend was already underway well before 2020, the pandemic accelerated the need for automation solutions, putting a spotlight on the importance of intelligent automation to sharpening your competitive edge. Yet, our research shows that more than a third don't have the visibility they need to make a determination about automation investment ROI.