AI-Powered Document Processing Is Changing Accounts Payable—Here's How

Maxime Vermeir

June 07, 2023

Modern finance is broken, forcing finance and accounting teams to work like it was in 1985 (the year Excel was invented). In this podcast episode, ABBYY thought leader Maxime Vermeir joins Jake Jones, Multimedia Producer and Brand Influencer at Zone & Co. on the Finance in the Clouds podcast. This discussion covers how artificial intelligence (AI), machine learning, intelligent document processing (IDP), and optical character recognition (OCR) work together to automate your invoice processing.

Episode transcript

This transcript has been edited for clarity.

Jake: Welcome to Finance in the Clouds. Modern finance is broken, forcing finance and accounting teams to work like it's 1985 (the year Excel was invented). Here, we talk about the struggles finance teams face in fast-growing companies and discuss how they can spend less time catching up and more time in the clouds.

I'm your host, Jake Jones, Multimedia Producer and Brand Influencer here at Zone & Co, and I'm joined this week by Maxime Vermeir, Senior Director of Technology Marketing at ABBYY, one of our partners. Thanks for joining us today, Max.

Max: I'm very glad to be here, Jake, absolutely.

Jake: As we continue talking about OCR invoice scanning, we brought our partners from ABBYY to discuss how artificial intelligence, machine learning, intelligent document processing, and OCR invoice scanning all work together to automate your invoice processing.

Max, it's great to have you on the show. We're really excited to talk about ABBYY and OCR invoice scanning, and a little bit about intelligent document processing. But before we get into that topic, I want you to tell our listeners a little bit about yourself and then also tell us about ABBYY and what you guys do.

Max: Yeah, absolutely, I'd love to. Again, I'm Max. I'm really glad to be here, and I'm the Senior Director for Technology Marketing. So again, thanks for inviting me over, Jake, and Zone & Co. I've been with ABBYY for a couple of years now, about seven, having gone through an entire range of different roles and functions at the company; you know, trying to get everybody out there to understand and evangelize really about what ABBYY does and how IDP (intelligent document processing) can really change people's lives. That's what I've been doing at ABBYY. So right now, I'm responsible for technology marketing, which is really great because I'm pushing, together with the rest of the company, for us to continue to be a leader in the intelligent document processing space. So that's one thing definitely to know about ABBYY. We are leaders simply because we combine our innovation and experience to transform any kind of document, any kind of format, any language, anytime, into actionable intelligent outcomes for our customers so that they can actually focus on what's important to them and not have to deal with documents all the time. And it's for that reason that, amongst others, Gartner and 10 other actually analyst firms have named us leaders in this particular industry. So, you know, having been around for more than 30 years, we have offices all over the world and large customers in the Fortune 500. And actually, if you count all of our customers, there's more than 10,000 of them. So we only have 20 minutes today, Jake, so I'm not going to count every single one of them, but there's a lot. We have a large partner network as well, which is why I'm very glad to be here again, working together with you on this podcast with Zone & Co.

Jake: Absolutely. We're so fortunate to have you guys as a partner. Started with Fast Forward, to give just a little history, of course, Fast Forward is now part of Zone. We're talking about this arc about OCR invoice scanning and how that whole process works. As I was talking with you, Max, ABBYY is not necessarily an OCR company. Your products play a huge role in how that process works. So let's start with intelligent document processing. Tell me what that is and then how does that fit into OCR invoice scanning and that whole process?

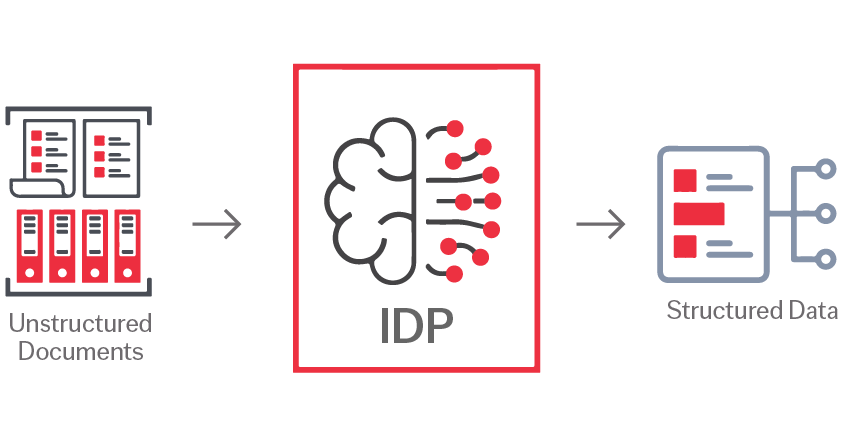

Max: That's really interesting. So actually, it's the other way around. How does OCR fit into the intelligent document processing world? The original technology was OCR, optical character recognition, building an engine that was able to guess from an image, that was entirely unreadable by a computer, on how to make that into actual data. (Going from that image over into actual data, that's where it all started.) Of course, you know the usage for that is quite limited. If you think back a couple of years when the whole conversation around AI began, everybody was like, "Oh, computer vision, computer vision, it's new." No, it's not. Computer vision was invented in the '80s, even before I was born. It's been around for a while, and that's why if you look at IDP (Intelligent Document Processing), OCR is one of the things that you need to be able to do. Intelligent document processing is about using, amongst other things, OCR, intelligent models that are based on machine learning (AI, as people today call it), and being able to make sense of the data inside of that document. Turning that into actual information that can be used by the business, that drives the business forward. So, everything around IDP is having straight-through processing; being able to take any kind of document you got. For example, invoices where you have the actual AP process, where you have lots of information in those documents coming in and going out. That's where intelligent document processing takes you one level higher because it's great if you just do OCR, that gives you, instead of an image, gives you text, and that's it, right? And you still have to do something with it. That's where intelligent document processing takes it up a notch by adding several other technologies to make sure that you actually get the content from that piece of text that's important to you in this particular process, which makes all the difference. And ABBYY, being again in the space for more than 30 years, we've seen it all—complex line items, complex documents, different languages. You know, over 200 languages that we support all over the world. We are actually able to process these documents, which makes a huge impact on our customers. Being able to have more than just the OCR but actually being able to get the data that they need to forward that process and get high accuracy rates and get high throughput. That's what's important. For example, one of our customers that we have, they have yields as high as 90 percent completely automatic throughput. Nobody's touching any invoices anymore except for the exceptions, of course, because you still want to have that human interaction too. We're not letting the Terminator loose on your documents, not at all. So you're in control, but it's actually helping you. And you actually see it in the market too that there's more and more about the "assisted automation", right? So that's a term that's now being phrased quite a lot because people actually start seeing how AI and machine learning can help them, instead of thinking that it's going to take away from what they do. You know, it's going to assist you in what you do and allow you to focus on what's important and not so much on, I would say, the repetitive work.

Jake: That's such a message we've heard in a couple of podcast episodes talking specifically about AI. It's not that you want everything to be automated, it's not that you want, like you said, the Terminator loose on your documents and in your system. But if you can use AI smartly to assist you in the mundane, it gives you a lot more freedom and time to focus on other things. I'm sure we'll talk more about that as we go on, but how does AI fit into OCR invoice scanning, and then again, intelligent document processing? How it fits into that picture?

Max: The AI part. It's technical jargon, right? So, you know, AI covers the umbrella term for everything in terms of machine learning, computer vision, all of it serves a purpose. In the sense that what we deliver is applied AI. So AI that you can actually use. Because if you look AI, at the theory about it, (what) the scientists are inventing, that's the mathematics. But what businesses are looking for is the applied AI—that actually helps them move forward. Using OCR, which is one of the components—which is the computer vision—if you look at the AI umbrella term. And then having data models, being able to understand what is in that document, and then actually extracting the information, classifying the information, and giving you only the pieces that you need. Allows you to have a solution that gets you up to 90 percent processed in a few minutes. Especially in invoices because it's such a use case that's out there. Everybody has invoices. Sometimes I really think it's what makes our world work is just sending other people invoices. It's been done. It's been tested. It's been tried. And it's something that we love helping our customers with because it's very successful. And it gives you really great ROI. One of our customers actually achieved a 91 percent reduction in invoice processing transaction costs. So I'm not talking about how fast can we go from this image that we originally started from to the data, no, no. The entire transaction cost went down by 91 percent simply because we added this automation in. Because we added the AI in. It's taking you up that level. So AI can really assist you in taking up your organization to a higher level and making sure that you can save both money and time. Together with our partners like Zone & Co.

Jake: Before we get too far away from this question because it's such a hot topic right now, a lot of companies are showing interest and how can we use this? How can we take advantage of this? The kind of question that I always have in the back of my mind is, how reliable is this AI? And I've heard you say 90 percent, 91 percent that sort of thing a couple of times now. How reliable is something like this for as far as invoice scanning and helping businesses reduce some of that mundane work?

Max: It's a great question, right? So the reliability does depend a lot on the experience of the provider, I would say, of these kinds of technologies. What you see in the market is you see a lot of niche players focusing on those very tiny bits. You know, one single language or one single kind of format. And then you get great results, just like with everything. If you focus really hard, then you get great results because that's the only thing you're working on. But that's not how businesses work. They get invoices from all across the world, in all different kind of formats and languages, and that is what ABBYY specializes in, specifically. Making sure we can cover that breadth. That comes both through our innovation and our experience; we've seen all of types of variations in a lot of different customers.

As for reliability, as always "bad data in, bad data out". So a lot of these things in terms of quality, does stem from the quality that you get at the start of it. If we're talking about paper processes, where you still get manual invoices or paper invoices, the scanning part is important to get that quality image, because you want to make sure you get good data out.

But in terms of the way that the AI and machine learning has evolved over time, the techniques that are now being used, it's become much more redundant in the sense that it does not require strict parameters on how it can think about things. I used to compare it to when your teaching a kid (back in early days of school) you start by memorizing things, but as you get higher in your education you're taught not to memorize things, but to reason and that's how you can see the evolution of IDP technology and all AI technology as well. They're starting to reason more and more. Let's be honest, its still a lot of rules but if you have enough rules and enough parameters built in, it starts to look more like reasoning and less like memory that's happening. That's all we're doing in our own (human) brains, as well. It's an interesting question, but I think we've been able to prove that out specifically, and certainly for an AP process or invoice processing, you can get high accuracy and it's very reliable. Not to forget we talked about the Terminator, well it's not here because we're using assistive AI. So that also means that even if it does get it wrong, you can provide feedback, to our (ABBYY's) platform and your (Zone & Co's) platform, and actually say, "You got this wrong. This is how you're supposed to do it," and it will incorporate that and it will continue to learn. Because nothing is perfect. And we're not saying that. Anyone who promises 100 percent (accuracy) out-of-the-box - don't believe them because nothing is perfect; because it's still built by humans, right.

It's important that you have that human-in-the-loop factor, too, for two reasons. One is what I just talked about: so you can continue to train and evolve it. But on the other hand it's also for people that are working with it to see, "this is helping and making my life easier". And for that, they just have to actually see how it works and what kind of benefits you get from it—and see that you still have control.

Jake: That's a great explanation, Max. I really appreciate a lot of that perspective—as you're taught as a child to memorize these numbers, memorize these letters, then as you get older you have to think about it. It's in the name machine learning—the AI is going to learn with you, it's going to learn as you go. That human element is always going to be part of it, but it's how efficiently and how effectively can humans be working with this AI to really maximize what you're doing.

From your perspective and from ABBYY's perspective, how can OCR, invoice scanning, and intelligent document processing, how can (these technologies) effect a businesses' outcomes and results?

Max: Look at where we are in history, right now, because I think it's important. What's currently happening in the markets, what's currently happening with the economy of the world—we've seen this before. But I think it's important that businesses realize what that means: the best way to learn from other's mistakes is to look at the past, see what happened, and it may look a little different, but still, there is a lot of repetition going on here. This is always the perfect time to actually go into elevating your business. (Ask yourself:)

- What can we do differently?

- What can we do to ensure that we can endure within this new world?

- What can we do to make sure we come out better in the other end?

And for that, you need to have good insights into what your businesses are doing. And especially finance leaders need elevate the conversation in thinking about what's driving your team; what value is my team delivering? Is that entering data—or is that thinking about our processes delivering the accounting, giving insights to the business? I think it's the latter.

The Changing Role of the Finance Leader

ABBYY Chief Financial Officer James Ritter shares insights on how finance leaders can adapt to the changing business landscape with the help of intelligent automation.

Max: We saw that in some surveys, for example The International Organization of Financial Managers Survey in 2022 revealed that about 75 percent of accounts payable teams report processing more invoices than most recently reported—up from 60 percent. That's interesting because what's happening now, after COVID, everything opened up again. That increase, we're going to see this fluctuation but still our economy will pull through, it always does—it's a cycle, and it's better to start preparing for that. Gartner suggests that by 2025, only 50 percent of business-to-business (B2B) invoices will be processed without manual intervention. So that is where the world is going anyways.

It's something for finance leaders to be thinking about, what should the focus be: is that during the process or is it about enhancing the process? And I think that's really important.

- Continuous improvement

- Better operating margins

- Investing in technology to gain new insights

Right, because we haven't talked about that part yet. If you only have your documents, it's really hard to get that information at a glance and make any sense of it. If you have the data (from your document), that's an entirely different story. You can get much better insights; you have much better decision-making possibilities because you have access to the right information.

I think there's a lot to think about regarding why these types of technologies can really make a difference for a business. They can use it to shift company focus from looking at costs to looking at actual profits. That's a huge difference.

Jake: When things are down, you need to prepare for that resurgence. Lots to think about there. I'd love to hear more of your thoughts, Max, on how we've been talking about how these programs can help you be efficient and eliminate some of the manual work, allowing your team to focus on other things. Obviously, that's a huge impact when your finance team can explore other ways to generate revenue. You mentioned data, and this solution provides a lot of data in a really easily digestible way. Let's talk about that a little bit, like you said we haven't touched on this yet, so I'd love to hear more about this.

Max: If you think about how things have evolved, it was only 50-plus years ago that we put a man on the moon. If you had a curve showing how technology has evolved, it was initially slow and then suddenly started going up and up—exponentially, and it's Moore's Law. It's as simple as that. Actually, we've already exceeded that law. But that also means that we, as humans, have to deal with so much more data because more and more information is being added to organizations. All of it is structured. I wish we were still in the time and age where everything in a computer was structured and easy to access. Even if the rooms were filled with mainframes, it was pretty clear as to what it did, how it worked, and what data was there. But today, almost everything is unstructured.

If you think about it, it's one less thing to worry about if you can quickly get the right insights from your data inside of documents. Right now, we're specifically talking about the accounts payable (AP) flow and invoices, which are really important and provide quick return on investment (ROI). It's great for businesses to start looking at that. But then, you can continue to evolve. Just having that data, even if we're only discussing finance, having those insights is a lot better than not having them. That's pretty obvious. Being able to gain insights from your data—that you have anyways—by making it accessible is a huge advantage over competitors who are not leveraging it. Yes there is a process to follow. Yes there are regulatory implementations you have to follow. But once you have access to the data, you can start looking at what your vendors are doing, how they work, when you are receiving their invoices? Are there any cost-saving opportunities? Maybe even potential revenue that can be generated; such as going back to the business and (negotiate) alternative deals that (can) lead to better discounts. These are all things that you can only do and only see if you have access to the data. That's why it's essential to make sense of all this information coming in, using AI to gain insights, make informed decisions, and put it to good work.

Jake: To that point as well, having all this information is one thing, but then you also have to have the time to truly analyze and think about it. Everyone is just trying to get by, trying to get to a successful sale. What you may notice, when you have access to all this data and the time to delve into it, you might notice problems that were didn't see before, and you can find solutions and make the process easier and more efficient. It's a cycle, where human eyes are on the big problems, while assisted AI takes on the process (you've set up), it's just a matter of getting the (manual) work done.

A lot of great conversation today, Max. But before we go, is there anything else you'd like to share or bring up about intelligent document processing or OCR invoice scanning?

Max: It's an amazing and exciting world out there around OCR, especially intelligent document processing. From my end, use it as a great first use case of intelligent document processing: AP invoices. It's a no brainer; ROI is incredibly high, as you (our partners) know as well. But then you can really get to work because you've already made back that investment. Then you can explore other use cases in your organizations. Because there are so many documents coming at us from every single angle, and there's an incredible amount of useful data locked away in them that right now, businesses simply don't have access to—so, let's get to work.

Jake: Max, we've had a great conversation today about OCR, invoice scanning, and intelligent document processing, what (these technologies) can do for your business, how it fits in to work processes. We learned how it can not only simply processes, it can give you a lot of data to really be able to look into the details and make improvements for your business. Great conversation, again thank you so much for joining us, Max and ABBYY. We're really happy to have you as a partner.

Max: It was really great to be here, Jake. Thanks again for inviting us (ABBYY). I think it was a great conversation. I hope the readers, listeners, viewers all find this interesting, too. Fell free to reach out, you can find me on LinkedIn or come on over to the ABBYY website, there is a lot to explore (learn about AP Automation or Book a Demo). I definitely hope to come back to your podcast, Jake, because it was a lot of fun.

Jake: We want to hear from you! How has your business been positively impacted by intelligent document processing? Let us know by emailing hello@zoneandco.com. "Finance in the Clouds" posts bi-weekly on Fridays. If you enjoyed today's conversation, be sure to subscribe to "Finance in the Clouds" wherever you get your podcasts or watch us on YouTube on the Zone & Co YouTube channel. Also, be on the lookout for articles and guides all about today's topic at zoneandco.com. We'll see you next time!