Tell us about your team and the dynamics of your team collaboration.

This is our second time participating in a hackathon contest, and we take pride in achieving this remarkable recognition. Fun fact, our automation expert Unnikrishnan has won hackathons in past UiPath events.

Our team consists of:

- Swaminathan Surendran, Business Head -Content Services at Tech Mahindra

- Bharathi Sathya, Practice Lead – ABBYY at Tech Mahindra

- Himani Soni, Sr. Engineer at Tech Mahindra

- Pradeep M, Engineer at Tech Mahindra

- Vipul Malik, Alliance Manager at Tech Mahindra

Tell us about the company you represent.

Tech Mahindra is a global consulting service and systems integrator that operates in over 90+ countries, delivering solutions with a unique blend of digital innovation and robust, industry-strong processes. With our promise to help our customers Scale at Speed™, we design future state solutions for industry leaders and offer innovative digital experiences that enable them to transform and scale at speed. Our aim is to enable enterprises, associates, and society to RISE for a more equal world, future readiness, and value creation.

What was unique about your team’s collaboration process?

The most unique and pivotal characteristic of our team’s collaboration process is that we always ensure a strong alignment on project goals, user goals, and understanding the business impact before kickstarting.

With these common grounds, we all worked in a synchronized and cohesive pattern while building the comprehensive automated loan application module. Keeping a strong focus on KYC document validation, the integrations of mandatory documents like Aadhaar cards, PAN cards, passports and voter ID were designed to deliver a seamless workflow. By aligning our technical and regulatory expertise, we ensured a smooth, compliant, and efficient automation strategy with streamlined user journeys that helped us accomplish an enhanced customer experience (CX).

What initially enticed you to participate in the ABBYY Shark Tank competition?

Our collaboration with ABBYY has proved to be instrumental in delivering top-notch AI-based enterprise content services to our customers. We were quite confident that participation in ABBYY’s Shark Tank competition will prove to be a cornerstone in demonstrating our innovation and tech skills. We perceived this competition to be a fertile platform for showcasing our adroitness in content services and introduce revolutionary use cases that would prove to be a game changer for our customers.

Besides this, with our strength and core expertise in AI technologies, we envisaged excellent opportunities on the following levels:

- Learning and growth: Our interest in optical character recognition (OCR) and AI technologies made us anticipate more knowledge sharing and gain insights on these trending technologies. Participating in the competition would help developers improve their skills, learn new technologies, and gain experience working with ABBYY's tools and APIs.

- Networking opportunities: ABBYY is a leading provider of OCR and AI-based solutions. We saw this as an opportunity to meet and network with industry experts and like-minded peers, developers and innovators to identify potential avenues for collaboration.

- Platform to innovate: The competition will encourage our developers to think outside the box, explore new ideas, and develop innovative solutions leveraging ABBYY's technologies. We think this is a great opportunity to nurture innovative minds that we have and offer them a platform to demonstrate their capabilities.

- Challenge and recognition: Competitions offer a chance to showcase skills, receive recognition, and learn from others.

Can you describe the project you developed during the ABBYY Shark Tank competition? What problem did your team focus on solving?

Our team focused mainly on solving the major three problems listed below:

- Disconnected systems, people, and lethargic processes that added to delay in loan disbursement.

- KYC and documentation were found to be a cumbersome task for many.

- Overall weak user experience in the entire process of availing loans.

In summary, our project on loan application automation considers the intersection of two types of users: financial institutions and their customers. The primary benefit of this application is to allow customers to request loans from the comfort of their homes while enabling the financial institutions to process loans more quickly, accurately and with minimal human intervention.

By introducing automation for the loan application process, the system enables efficient processing of online loan applications with a paperless digital approach that enhances satisfaction of banks and customers alike.

Core features:

- Speed: processes loan applications 80% faster

- Technology used: ABBYY Vantage, portal based on Java and Spring

- Operational efficiency: enhances data extraction and validation accuracy, significantly improving efficiency and reducing manpower costs

- ROI: reduces operational expenditure by 90% and ensures 100% loan compliance

The asset is now available on the ABBYY Marketplace.

How did attending AI Pulse Developer Conference influence your understanding of intelligent automation?

Attending the AI Pulse Developer Conference had a significant impact on understanding intelligent automation in several ways:

- Exposure to latest technologies: The conference provided insights into the latest advancements in artificial intelligence and machine learning technologies that drive intelligent automation. This exposure will help deepen understanding of how these technologies are evolving and being applied in various industries.

- Practical applications: By attending sessions and workshops, participants witnessed real-world examples of intelligent automation in action. This helped in understanding how different companies are leveraging AI to automate processes, improve efficiency, and reduce costs.

- Expert insights: Hearing from industry leaders, experts, and innovators offered valuable perspectives on the future of intelligent automation, its challenges, and opportunities. This helped refine one’s understanding of where the field is heading and what skills or knowledge areas are becoming increasingly important.

- Networking with peers: Engaging with other developers, engineers, and professionals who are working in intelligent automation provided a broader view of the current trends and common challenges. These interactions lead to collaborative learning and sharing of best practices.

- Understanding market needs and user expectations: By interacting with a diverse group of attendees, including potential users and customers of intelligent automation solutions, it helped in interpreting market demands, customer expectations, and how intelligent automation can meet those needs effectively.

How do you plan to apply ABBYY products in your future projects to enhance intelligent automation?

Applying ABBYY products to future projects can significantly enhance intelligent automation in several impactful ways:

- Automating document processing: ABBYY's OCR and document processing solutions can be integrated to automatically extract and process information from scanned documents, PDFs, and images. This can reduce manual data entry and speed up workflows in industries like finance, healthcare, and logistics.

- Data capture and analysis: By leveraging ABBYY’s data capture technologies, we can automate the extraction of data from various sources, such as forms, invoices, and contracts. This structured data can then be used for analysis, decision-making, and triggering automated workflows, enhancing the overall efficiency of business processes.

- Enhancing RPA (robotic process automation) workflows: ABBYY’s intelligent document processing (IDP) tools can be combined with RPA platforms to enable more sophisticated automation scenarios. For example, using ABBYY to understand unstructured data can make RPA bots more effective by allowing them to handle a broader range of tasks that involve complex documents.

- Improving customer experience: In customer service and support, ABBYY’s text recognition and natural language processing (NLP) capabilities can help automate responses and categorize incoming queries. This not only speeds up response times but also ensures more accurate handling of customer requests, thereby enhancing the overall customer experience.

- Compliance and risk management: ABBYY’s products can be used to automate the monitoring and management of compliance-related documents. By automatically extracting and analyzing information from contracts, legal documents, and financial records, organizations can ensure they remain compliant with regulations, reducing risk of infractions and penalties.

- Streamlining supply chain operations: In supply chain management, ABBYY's solutions can be applied to automate the processing of orders, invoices, and shipping documents across all its functions.

Could you share one of your favorite moments or interactions, whether with other participants, speakers, or ABBYY staff during ABBYY’s 2024 AI Pulse Developer Conference?

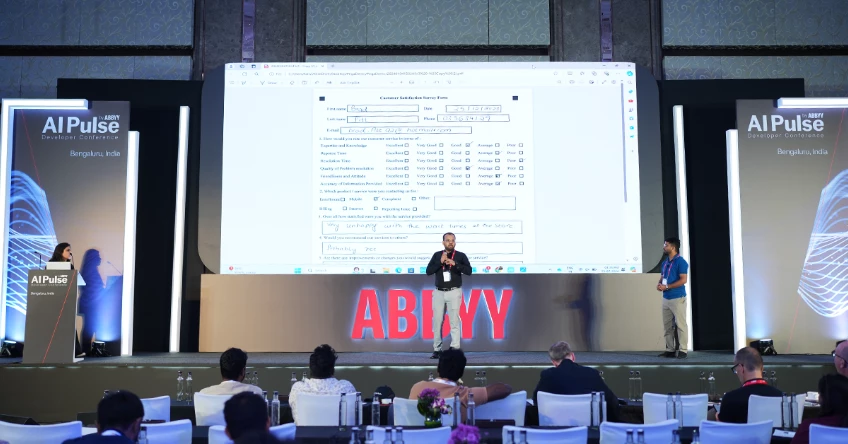

Some of our favorite perks from ABBYY's 2024 AI Pulse Developer Conference were the many opportunities to meet several well-known ABBYY professionals in person. It was great to connect face-to-face. We particularly enjoyed the demo on integrating ABBYY with ChatGPT, presented by Rahul Kapoor, and API integration by using Postman, presented by Deepak Goyal (pictured below).

AI Pulse by ABBYY: Developer Conference

Level up your ABBYY expertise and network with some of the greatest minds in the ABBYY community of marketers and developers. Stay tuned for more events in 2025. If you would like to get insights and updates from ABBYY, please subscribe here.