Thrive in a Post-COVID World: The Future of Financial Institutions and Insurance Organizations

Eileen Potter

April 23, 2021

The pandemic forced financial institutions and insurance organizations to make overnight changes in how they operated, and for two industries not known for speed in adapting to change—or changing processes on the fly—this proved that they can be nimble when they need to be. It was almost like these established organizations had an overnight shift in culture, trading in their suits and ties for hoodies to become more accessible and focused on customer experience.

Many of the operational changes exposed gaps in existing digital capabilities, and some of these changes—like the shift to remote work and virtual customer engagement—appear to be settling in as the new normal.

According to a recent McKinsey study: Fully 75% of people using digital channels for the first time indicate that they will continue to use them when things return to “normal.”

While both industries were able to survive this year by making temporary fixes to processes so customer service wouldn’t suffer, it has become clear that there is a significant need to accelerate digital adoption and enhance virtual operations, finding better and more permanent solutions to address those gaps.

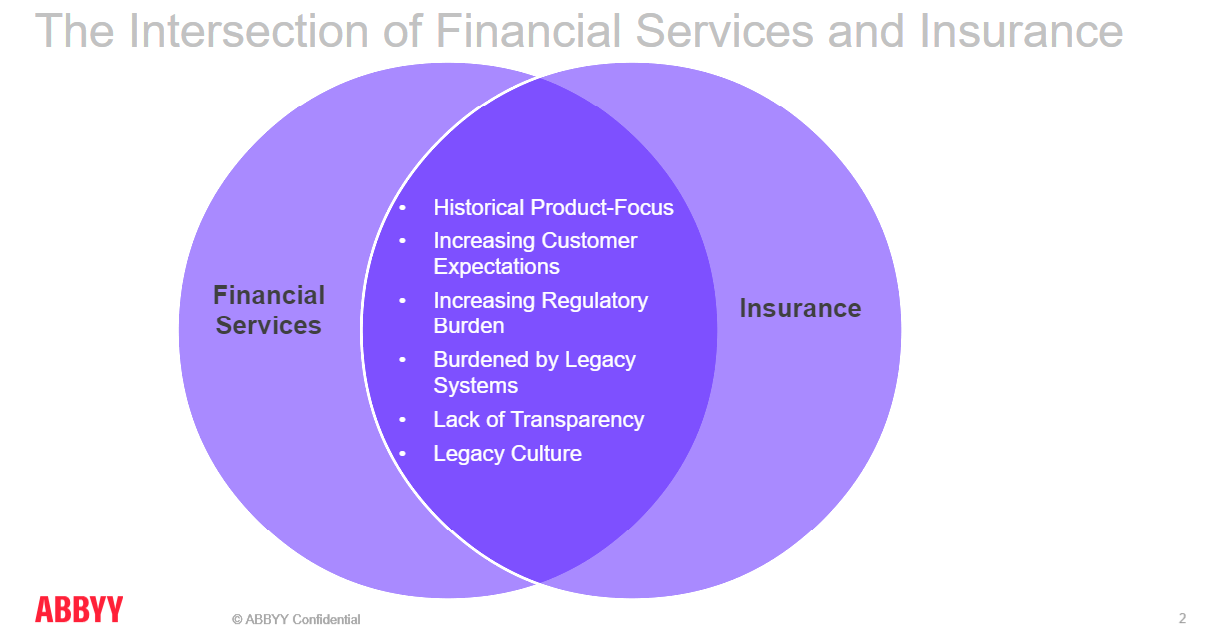

As part of a recent presentation we gave at OPEX Financial Services, my colleague, Cheryl Chiodi, and I put together a Venn Diagram to illustrate what we called “The Intersection of Financial Services and Insurance.” And the areas in common are exactly why both need to reset, reinvest, and reimagine their business operations to compete with Fintechs and Insurtechs, so they can be ready for what is next—and what will be the next after that—whatever that is.

So, how can established organizations in both industries thrive going forward? Here are three of the main challenges we see, and some of the ways organizations can respond:

Increasing customer expectations

It would not be an overstatement to say that customers have an expectation of now—and that their expectations are being set by their last, best digital experience. The time of rushing over to a bank branch or insurance office during “business hours” is long over, and hours of operation are no longer being set by the bank or the insurance company, but by the customer. They want to be able to communicate using their channel and device of choice, and they expect faster response times for policy quotes, claims settlement, and credit decisions. Streamlined account opening and onboarding are table stakes.

Forward-thinking organizations can facilitate this digital engagement with Process Intelligence, enabling them to personalize the customer journey and help to ensure customer loyalty.

Burdened by legacy systems and manual processes

Financial Services and Insurance are document-heavy, decision-based industries, running a complicated web of disparate, siloed systems and databases. The result? A lack of visibility into how processes are working today and where the inefficiencies and bottlenecks are. Digitizing processes and innovating with technologies like artificial intelligence (AI), machine learning (ML), robotic process automation (RPA), and natural language processing (NLP) will enable them to accelerate the response to business and market changes, and improve process efficiency for both internal and external stakeholders.

Evolving regulatory landscape

While both industries have always been heavily regulated, the new level of remote work has placed an increased focus on data governance due to privacy laws. There is a renewed emphasis on enabling a level of visibility into audit processes and provide controls through monitoring and alerting, ensuring an accurate, aggregated view of risk across the business.

It’s not exactly breaking news to talk about how much the business landscape for both industries has evolved over the past several years, and the pace of change only seems to be accelerating. If 2020 taught us anything, it’s that agility and resilience are critical to successfully navigating those changes. Financial institutions and insurance organizations need to cultivate both as part of their company culture going forward so they can thrive in 2021, and beyond.

Watch our recent session at OPEX Financial Sessions to see how Digital Intelligence can help reduce friction and simplify processes.