Your Intelligent Process Automation Journey Requires Training Like a Marathon

Cheryl Chiodi

October 06, 2022

I recently completed the Boston Marathon and from my experience, training for and running a 26.2-mile race is SIMPLE. All that is required is a commitment to wake up before sunrise six mornings a week for 18 weeks and run between seven and 22 miles at varied levels of intensity. Is it easy? No, don’t confuse simple with easy—it’s hard.

To be successful you need consistency day-in, day-out. Even on days when you feel like you failed or if conditions outside your control prevented your planned run. Of course, we’re all smiles when we begin—everyone is at the same pace, we’ve got the same goal in mind, working towards the same objective—why wouldn’t we be smiling? It’s all going to go exactly as planned. Until…

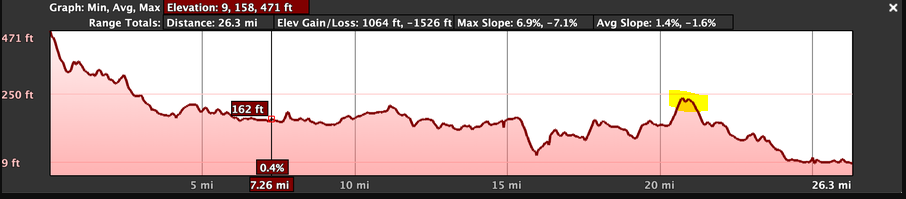

That notorious roadblock hits: Heartbreak Hill. We think we’ve prepared well and heeded all the warnings about how difficult it will be. But by the time we get there, we’ve spent a lot of our resources, feel exhausted, lost a lot of the enthusiasm we had at the beginning, and maybe our support system has dwindled too.

Heartbreak Hill highlighted in yellow

It’s the same scenario when undergoing a digital transformation project. How do you plan for unexpected challenges? There may be shifts in the market, a global pandemic, war, a huge leap in inflation, talent shortages, and rumblings of a recession. And more importantly, how do you remain resilient and committed to finish your intelligent automation journey when these impossible forces are working against you?

Just as distance runners use digital tools to track their pace, miles, intensity, elevation, heart rate, and nutrition, you too need to track the way your business runs using new digital processes and tools.

Improve your processes with real-time insight from your own systems. Try ABBYY Timeline.

You might start with gathering data about the way your customers interact with your brand across different channels, develop a hypothesis on what can be improved and how, run a test with strict control, then diligently analyze the results. After that you gather new data to uncover more insights and run additional tests. It’s a structured process. Simple, but not easy.

Just like nutrition, adverse weather, and injury can impact the overall success of a 26.2-mile race, so can the many processes, people, and disjointed data that make up your day-to-day business operations. Here are four ways your intelligent process automation journey can be treated like a marathon to ensure you get the results you want.

Assess the route

Understanding the intersection of your people, processes, and data is the starting point for true business transformation. You need to connect the paths between how users complete tasks when interacting with system logs and business data to better reduce process friction, improve customer service, reduce costs, and accelerate business value. The future of work requires us to reimagine how work gets done across multiple teams, machines, and interactions. It’s about having a GPS map view of your end-to-end operations.

We cannot tolerate business processes that make our employees' jobs more challenging. A recent ABBYY study among financial services staff showed that over half of respondents believed business processes made their job more difficult, while 44% said they wasted their time. Don’t let that be your staff.

Maximize energy (aka budget)

Our instinct is always to do more—train harder, go out faster, spend more. But, is more always better? Will spending more on KYC result in the outcomes you are searching for? Not necessarily.

For example, today, the amount of money laundering that occurs each year is equivalent to as much as 5% of global GDP, according to the United Nations Office on Drugs and Crime (UNODC). Most of these illicit funds pass through the financial system. To combat this, banks employ approximately 10% of their workforce towards combatting financial crime. KYC reviews are usually the costliest activity because it is still largely reliant on manual, error-prone processes.

Just as successful marathoners need to plan for the complexity of the entire course, not just the hills or the start or the finish, financial institutions must consider the complete end-to-end process, with the goal of achieving straight-through-processing. With this strategic mindset, the rewards will far exceed a medal or a personal record—improved customer experience, regulatory compliance, and better-quality KYC reviews are some of the trophies that can be obtained.

How Financial Services Firms Are Becoming More Resilient Than Ever

View the infographicKeep a steady pace

Studies suggest that marathoners who start out too fast and give it their all early in the race finish significantly slower, get injured, or lose motivation, yet, it happens all the time. The runner thinks that if he or she starts fast, they’ll get to the finish line quicker. It makes logical sense, but that kind of thinking comes with all kinds of perils.

Similarly, many organizations hastily rolled out new tools during the pandemic to automate and move their business processes to the cloud to accommodate remote workers and offer new digital services to customers that were contactless and self-service. Onboarding was among the priorities. Although bank leaders said they wanted to streamline onboarding and accelerate the process, we’re finding they were largely unable to remove enough friction to delight customers and stop them from dropping out.

A common challenge during the onboarding process is identity affirmation and identity proofing—assuring the identity documents are valid, authentic, and that the applicant is who they say they are. This is a document-centric process that requires a seamless path for the mobile capture of documents, extraction of data into backend systems, and an elegant interface that delights customers. You don’t want to get to the finish line with a broken ankle—you want to get there in a healthy state, with the right information and correct, reliable data.

Have good training partners

Marathoners depend on many partners to complete their race. Trainers for guidance on speed, endurance and agility, nutritionists to ensure they are inputting the right fuel, physical therapists to help with injuries, and friends and family for emotional support. Likewise for your intelligent automation journey, you need partners who can keep you on the right trajectory towards success.

Not only will your intelligent automation partner analyze your strengths and weaknesses, they’ll make sure the whole team is coordinated at the starting point, most importantly, your staff, who must be motivated and firmly onboard with any changes. Your partner will be able to identify what technology and key services you need for maximum efficiency, deliver better business value, improve customer service, open new opportunities, and more importantly give you the possibility to scale when needed. In addition, they’ll be there for your post implementation to support you and your employees with training and assistance to ensure continued success. After that, you’ll be ready for your next race, or should I say your next intelligent automation project.

Download the results of this survey to evaluate where your financial institution stands with its digital strategies.

Cheryl Chiodi completing the 2021 Boston Marathon.