No Time to Lose: Solving Document Challenges in Insurance

Eileen Potter

April 19, 2022

Insurers today still struggle to deal with the enormous volume of documents that are part of the policy administration and claims lifecycles. In addition to standard forms and applications, loss runs, repair estimates and invoices, there is additional information–both semi-structured or unstructured–entering the organization through various communication channels in different formats and layouts.

View the Infographic: Solving Document Challenges in Insurance (ABBYY Survey Results)

Policy administration and claims management core systems automate transactions and workflows, but in today’s digital world, that’s simply not enough.

Consider the following

A recent ABBYY survey found that 69 percent of insurers feel that they are wasting at least 8 hours each week trying to find, understand, and process data in documents.

That is more than a full day of lost productivity.

The detailed responses clearly showed the negative impacts to the business, including process delays, errors, poor business decisions, and most importantly–bad customer experience.

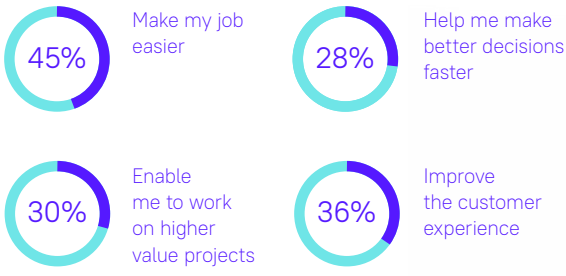

And when asked how a more intelligent document processing technology could help them, the answers ranged from making my job easier, faster and better decision-making, enabling work on higher-value projects, and yes–improved customer experience.

So, if insurance organizations—and their staff—see the need for improvement, what’s holding them back?

Next-gen technology

The missing piece of the automation puzzle is Intelligent Document Processing (IDP). IDP uses artificial-intelligence-based technologies to process structured, semi-structured, and unstructured documents. IDP can replace manual processing, enabling not only automation, but also creating more efficient ways of interacting with customers–i.e., no-touch, mobile, digital first, anywhere, anytime.

Until recently, the ability to extract useful data and insights from documents and content was reserved to human intelligence and highly complex tools that took months to set up, requiring highly skilled technical users. Low-code / no-code has changed the game. With the advancements of artificial intelligence (AI), machine learning (ML), and natural language processing (NLP), this advanced technology is now being delivered through simple design tools and pre-trained machine learning models.

The times when automating one single process would require months in development and testing, skilled professionals, and IT budget are long gone.

Meeting the challenge

Easier to implement IDP solutions speed time to value and empower underwriters, adjusters, agents, brokers, and contact center staff to understand documents and extract meaning from them, increasing efficiency and improving customer experience throughout the policy and claims lifecycle—regardless of volume and complexity.

This allows every department in the organization to move fast and push the boundaries of automation to drive better outcomes like

- increased new business,

- improved retention,

- and faster time-to-close for claims.

Additionally, IDP platforms are capable of providing trained cognitive skills to digital workers, enabling them to process content as humans would, by identifying many variations of a document, locating and extracting data, and delivering it to core policy administration and claims systems–further triggering processes, and involving human interaction to only handle exceptional cases–ultimately increasing the overall percentage of straight-through processing.

Insurance organizations have long focused the majority of their automation efforts on modernizing core systems, which has left gaps in processes that can be helped by AI, ML, and NLP. Technologies like these are key to continuous process improvement–driving better underwriting and claims outcomes and improving customer, agent, broker, and employee satisfaction. This is why next-generation IDP platforms like ABBYY Vantage should be an integral part of insurers’ hyperautomation strategy.

Ready to strategically automate and digitize your policy and claims processes?