Document Fraud Detection

Protect your organization from document fraud

The financial impact of document fraud

Digitizing your business operations brings numerous improvements, including increased efficiency and improved data management. But it also comes with significant risks: the low barrier to document forgery and fraudulent transactions. These transactions cost organizations across the world an estimated 5% of their annual revenues, amounting to $5 trillion.

The banking and financial services sectors are the most attractive industries to criminals and fraudsters, closely followed by insurance, healthcare, and government organizations. To protect their profits, reputation, and customers, organizations are tasked with increasing their investments in preventative resources to meticulously review and check incoming documents.

Organizations face significant challenges with fraud detection

Inefficient and expensive manual verification

Manually reviewing incoming documents is a slow and error-prone process. It requires significant employee resources, but delivers relatively low detection rates due to the sophisticated tampering methods criminals use.

AI-based solutions provide instant results with higher accuracy and lower cost.

Mix of document types, formats, and quality

Business documents often come in a range of file formats, document types, and levels of quality (including PDFs, scans and photos). Sorting through unclassified documents often proves challenging for fraud detection solutions.

Organizing and normalizing incoming documents and data prior to feeding them into a specialized fraud detection solution increases success rates.

Incomplete fraud detection solutions

Implementing simplistic fraud detection solutions that focus only on detecting image manipulation misses the enormous opportunity that the data contained in the document provides.

Combining checks for image manipulation with rule-based data cross-checks is a more powerful and accurate way to detect fraudulent documents.

Constantly evolving fraud landscape

It’s easier than ever for criminals to access fraudulent document templates. As modern technologies and AI mature, it’s becoming more challenging for organizations to differentiate these templates from genuine documents.

Purpose-built AI solutions intelligently learn and detect the latest fraudulent techniques, making them the only feasible and future-proof approach for successful fraud detection.

Safeguard your critical business processes with best-in-class fraud detection technologies

Mortgage and consumer lending

Insurance claim processing

Benefits enrollment

Payments

Explore ready-to-use AI extraction models

for document fraud detection

Fortiro Protect & ABBYY Vantage

Fortiro Protect is the industry-leading solution for document fraud detection and is trusted by major banks and lenders, insurers, and other enterprises.

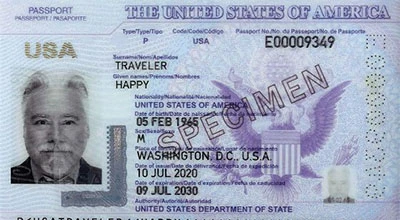

Identity Documents (ID)

The Vantage identity document (ID) Skill is a pre-trained AI model to extract information from passports, US driver licenses, residence cards, US Social Security card, and other ID cards from various countries.

Smart Extraction With Fraud Detection

Enhance trust in your document workflows by combining ABBYY Vantage’s intelligent document processing with Resistant AI’s advanced fraud detection.

Fortiro Protect

The ABBYY Vantage connector for Fortiro Protect allows you to seamlessly integrate the industry-leading solution for document fraud detection within your document processing workflows.

How AI-driven document fraud detection works

- Collect and automatically classify

- Extract and validate

- Analyze document

Collect and automatically classify “proof of” documents

Organizations receive a range of documents, including:

- Proof of identity – passports, identity cards, drivers licenses

- Proof of income – payslips, bank account statements, tax statements

- Proof of residency – utility bills, proof of address, mortgage bills

- Proof of payment – invoices, receipts, bank statements, payment confirmations

- Proof of delivery

These documents come through different channels, such as emails, mobile capture processes, or chatbots, in a variety of formats.

ABBYY IDP applies AI-based classification to detect different documents, classify and tag each document type, and route them to purpose-built AI models for further processing.

Extract and validate required data with AI models

Purpose-built AI models, called “skills”, accurately extract, normalize, and validate key data from each document type based on pre-defined business rules. These validation methods can include:

- Cross-checking ID data with data contained in the MRZ (machine-readable zone) of the ID

- Cross-checking line item amounts on an invoice against its total

- Confirming document validity based on expiration date or date of issue

Any extracted data that doesn’t match the requirements is flagged for manual review and special attention.

Analyze document authenticity with AI

AI-based document forensics solutions perform complex authenticity checks within seconds through layout, content, and digital analysis. The forensics search for use of blacklisted fraudulent templates, document reuse, digital modifications, and more.

The underlying AI models continuously learn and improve with each document they analyze, while incorporating assessment techniques from emerging fraud practices.

The solution then provides risk assessment scores and supporting data to expedite decision making.

Prevent fraud with best-in-class, AI-based intelligent document processing and fraud detection

Risk mitigation and compliance

Protection from financial losses

Preserved reputation and customer trust

Streamlined operations

Fraud detection FAQs

What is document fraud?

What are the different types of document fraud?

Document fraud is generally carried out with two types of document: false and genuine.

False documents are entirely fabricated without any legitimate records. These documents intend to deceive by presenting fictitious information as genuine. Criminals may create or use false documents through techniques like:

- Document forgery. Document forgery involves creating a fake document entirely from scratch to imitate a genuine one.

- Template fraud. One of the oldest examples of cyber crime, criminals use editable templates to create passable fake documents.

- Synthetic identity fraud. Synthetic fraud typically involves combining real and fake information to create an entirely new, but fictitious, identity.

- Generated document fraud. With this newer type of fraud, criminals prompt consumer AI software to create documents for them from scratch.

Genuine documents are legitimate documents that are altered or duplicated to misrepresent information. These documents may have been authentic, but are manipulated to serve fraudulent purposes. For example:

- Identity theft. This common type of document fraud is the act of obtaining someone's personal information without their knowledge or consent, and using it for fraudulent purposes.

- Pre-digital document modification. This sophisticated example of document fraud involves altering a document, printing it, and then scanning or photographing it to produce a new digital file. This is done in an effort to remove the document’s digital fingerprints and traceability.

There are other types of document fraud (such as serial fraud, which requires carrying out several of the other fraudulent activities on a mass scale) that have become increasingly common in large organizations.

What types of documents are most commonly faked?

The most commonly faked documents include identification documents (such as driver's licenses and passports), financial documents (like payslips and bank statements) and utility bills.

Fraudsters often target these documents because they can provide access to critical services, from loans to residency. Criminals will generally use fraudulent documents to misrepresent their identity, financial status, or residency details to give them access to financial benefits and services.

What industries can benefit from a document fraud detection solution?

The access and ease of committing document fraud has made it crucial for organizations across industries to prioritize document verification. There are a range of industries that can benefit from implementing fraud detection solutions. These include:

- Banking and finance – Detecting fraudulent documents can prevent fraudsters from accessing funding, loans, or laundering money.

- Insurance – Ensuring the legitimacy of documents avoids false claims and inflated payouts.

- Healthcare – Providers can authenticate patient identities and insurance details, to ensure appropriate care outcomes.

- Government agencies – Better fraud prevention solutions will improve the integrity of immigration processes and benefits distribution.

- Real estate – Checking documents are genuine will verify legitimate property ownership and tenant information.